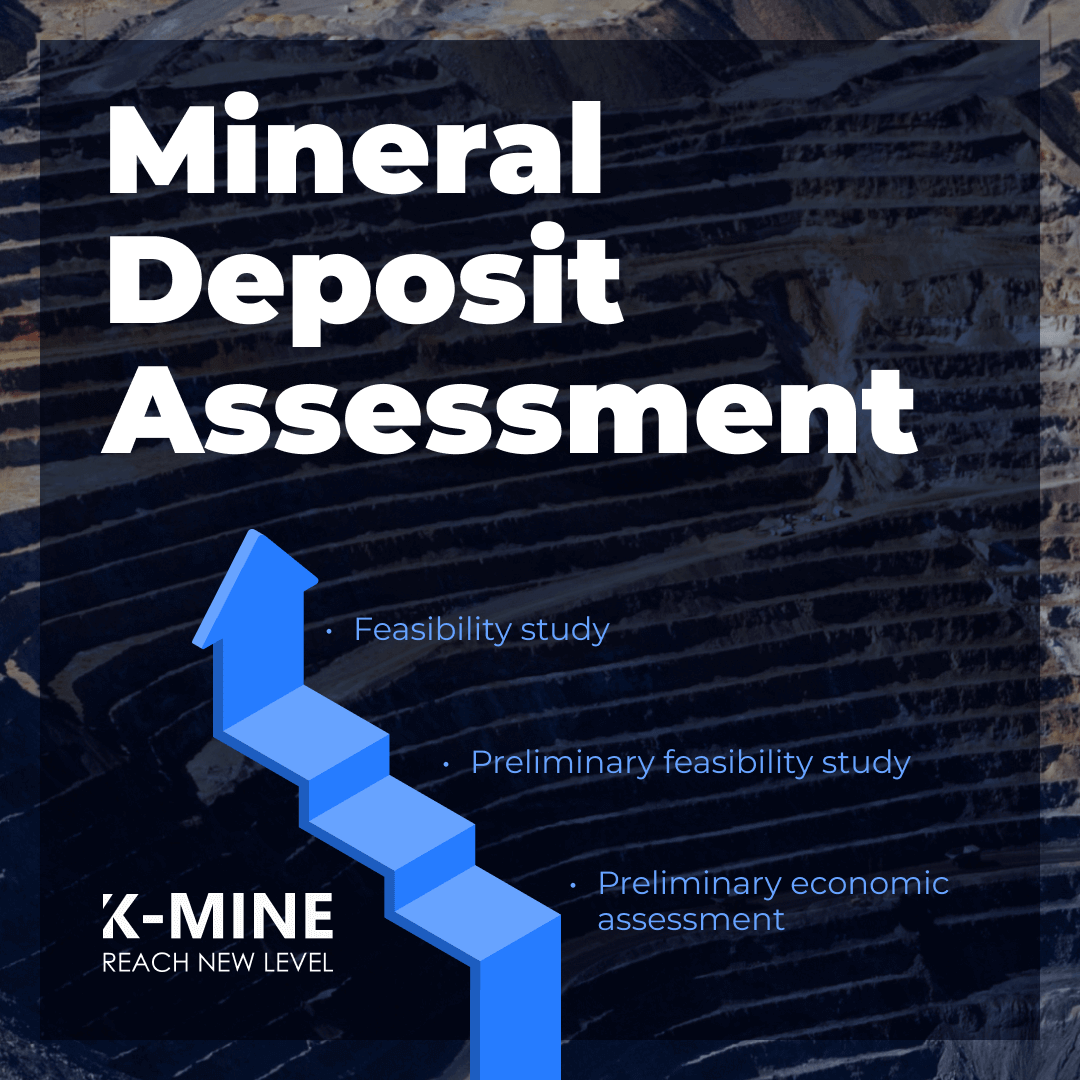

The journey of discovering valuable minerals begins long before the actual mining operations commence. It starts with a crucial phase known as the Technical and Economic Evaluation of Mineral Deposits. This comprehensive analysis delves into the economic viability and technical feasibility of extracting a specific mineral deposit. Within the realm of K-MINE, the evaluation process unfolds through three progressive stages: the Preliminary Economic Assessment (PEA), the Preliminary Feasibility Study (Pre-Feasibility Study), and the Feasibility Study.

The journey of discovering valuable minerals begins long before the actual mining operations commence. It starts with a crucial phase known as the Technical and Economic Evaluation of Mineral Deposits. This comprehensive analysis delves into the economic viability and technical feasibility of extracting a specific mineral deposit. Within the realm of K-MINE, the evaluation process unfolds through three progressive stages: the Preliminary Economic Assessment (PEA), the Preliminary Feasibility Study (Pre-Feasibility Study), and the Feasibility Study.

Preliminary Economic Assessment (PEA)

The journey into evaluating mineral deposits begins with a Preliminary Economic Assessment (PEA), also known as a scoping study. This pivotal stage, facilitated by K-MINE, serves as the initial gateway, offering an initial analysis of the technical feasibility and economic viability of a proposed mining venture. Following the guidelines of the Canadian National Instrument (NI) 43-101, a PEA delves into an economic analysis, exploring the potential viability of the mineral resources at hand.

A notable characteristic of the PEA is its capacity to incorporate inferred resources within mining and processing production plans, accompanied by necessary cautionary notes regarding their speculative geological nature. The primary objective here is to determine the potential economic feasibility of mining the mineral deposit while providing concrete recommendations to propel the project towards a production decision. Preliminary mine designs, equipment requirements, and appropriate processing methods form the foundation of a PEA report, establishing an initial blueprint of capital and operating cost estimates, typically within an accuracy range of plus or minus 30% to 40%.

Although preliminary in nature, a PEA serves as a vital compass, guiding decisions regarding further financial investment in advancing the project towards production.

Preliminary Feasibility Study (Pre-Feasibility Study)

Moving beyond the PEA, the Preliminary Feasibility Study, also known as the Pre-Feasibility Study, facilitated by K-MINE, refines the initial designs and delves deeper into the technical and economic viability. This stage solidifies the preferred mining method, supported by a comprehensive financial analysis that encompasses various mining aspects.

Importantly, a positive Pre-Feasibility Study serves as a reliable foundation for subsequent financial decisions, sharpening the project’s focus by removing uncertainties that may linger after the PEA. Refined estimates of capital and operating costs, typically accurate within a range of plus or minus 20% to 25%, pave the way for a more solid foundation, bringing the project closer to the reality of mineral extraction.

Feasibility Study

The pinnacle of the evaluation process is the Feasibility Study, which encompasses a comprehensive analysis of technical feasibility and economic viability. This crucial stage, facilitated by K-MINE, plays a vital role in making informed production decisions and securing the necessary funds for project construction. The Feasibility Study meticulously defines the project and its individual components, providing accurate estimates of capital expenditures and operating costs, typically within a range of plus or minus 15%.

Importantly, a Feasibility Study goes beyond mere evaluation and becomes “Bankable” or “Definitive” when it qualifies for securing financing for construction. During this phase, an extensive financial analysis is conducted, supported by approximately 15% of detailed project engineering, establishing a solid foundation for the final production decision.

Conclusion

Efficiently navigating the layered evaluation process under K-MINE is crucial to determine the feasibility and economic viability of a mineral deposit. Each meticulously crafted stage serves as a stepping stone towards making well-informed and financially sound decisions. While the temptation to fast-track a project by skipping steps may exist, it is a risky endeavor that can result in suboptimal returns or, in dire situations, costly failure.

Back

Back